Life sometimes throws us into routines that, despite being comfortable, can keep us financially and emotionally drained. Jake and Kelsey Bang were once part of this cycle. Struggling under $80,000 of debt, they made a drastic but ultimately transformative decision: to sell nearly all their possessions, downsize into a 240-square-foot RV, and hit the open road. This brave leap didn’t just change their finances; it transformed their lives in ways they never expected. In this post, we’ll dive into their story, highlighting key insights, challenges, and the bonuses of RV life that have given them freedom and fulfillment. Plus, we’ll share some practical tips for those who might be ready to make a change of their own!

The Debt Wake-Up Call

For Jake and Kelsey, debt was a daily weight, and despite stable jobs, they felt trapped. With high expenses and little left over to invest or save, they knew something had to change. The “aha” moment came when they realized the cost of maintaining a larger home, multiple cars, and a storage unit full of things they rarely used.

Instead of focusing on their possessions, they wanted to focus on experiences, relationships, and financial independence. The first step was making the tough decision to downsize—way down.

The Journey Begins: Downsizing to an RV

The Bangs sold nearly all their belongings, including their house and second car, moving into a compact RV that became their home on wheels. For many, the idea of giving up traditional stability for 240 square feet of space might seem impossible, but Jake and Kelsey were ready for the challenge.

Their small RV space forced them to simplify and prioritize only the essentials, eliminating unnecessary expenses. In the process, they reduced their cost of living drastically. Insurance, utilities, and maintenance expenses plummeted, and so did the urge to buy more "stuff."

Pro Tip: Try the 90/90 Rule. If you haven’t used something in the past 90 days and don’t foresee using it in the next 90 days, it’s a good candidate to sell, donate, or toss.

Lessons Learned from the Road

Living in an RV brought unexpected insights for Jake and Kelsey, impacting not just their finances but also their lifestyle and mindset. Here are a few lessons they shared:

Minimalism isn’t just about less stuff; it’s about more freedom. Downsizing showed them that “things” often create barriers, not freedom. With fewer belongings, they felt lighter, and as their debt reduced, so did their financial stress.

Flexibility becomes your greatest asset. Life on the road requires a level of adaptability that changed their approach to everything. Adapting to new places, weather changes, and even vehicle maintenance taught them patience and resilience.

Relationships grow stronger when you’re focused on experiences over things. Living in such close quarters has strengthened their relationship, taught them communication, and built memories that a more traditional lifestyle couldn't have offered.

Financial freedom leads to other freedoms. With debt no longer dictating their choices, Jake and Kelsey found themselves free to explore new career options, take risks, and enjoy moments without worrying about finances.

The Financial Upside: Saving on RV Living

RV life isn’t just about reducing debt; it’s about building financial flexibility. Here’s how the Bangs maximized their savings:

Lower Utility Costs: RV living means fewer expenses for heating, water, and electricity. Many RVs are energy efficient, and you only pay for what you use.

Minimal Housing Costs: Renting spaces at RV parks or staying at free camping grounds is far cheaper than a mortgage or even rent in many cities.

Travel at Your Own Pace: Without job or school schedules dictating their timeline, they could choose affordable routes, saving gas and finding low-cost, scenic places to park for extended stays.

Bonus Tip: Look for discount memberships like Passport America or Harvest Hosts. These services offer low-cost or even free camping options, ideal for long-term RVers.

The Unexpected Joys of RV Living

Living in an RV has brought Jake and Kelsey closer to nature, and to each other. It has opened the door to a new community of like-minded travelers and taught them to appreciate the beauty of small, simple pleasures—sunrises over mountains, coffee by the lake, or quiet evenings under the stars.

RV life has given them a newfound appreciation for flexibility and gratitude for simplicity. They've discovered a lifestyle that is financially smart, rewarding, and full of unexpected joys.

Could RV Living Be Right for You?

Jake and Kelsey’s journey is inspiring, but it’s not for everyone. Downsizing and RV living requires a love for adventure, the willingness to embrace change, and a desire for a simpler lifestyle. Here are a few tips if you’re considering a similar path:

Start with a Test Run: Before selling everything, try renting an RV for a few weeks to get a feel for the lifestyle.

Plan Your Finances: Budget not only for the RV but also for fuel, insurance, and campground fees. It’s essential to know what costs to expect.

Sell What You Don’t Need: Use the proceeds from selling unnecessary items to pay down debt or invest in your RV setup.

Join RV Communities: Online groups and forums are full of tips, advice, and support for new RVers.

Final Thoughts

Jake and Kelsey Bang’s journey from debt to financial freedom shows that unconventional choices can bring unexpected rewards. They took a risk, traded comfort for growth, and, in doing so, gained a life of freedom, financial control, and unforgettable experiences.

Whether or not RV living is for you, Jake and Kelsey’s story reminds us that financial freedom isn’t just about money—it’s about finding a lifestyle that brings joy, fulfillment, and a renewed sense of purpose.

Thinking about RV life? Let us know your questions or share your own experiences in the comments!

Here's what you can expect from Bartelle's Financial Coaching:

Personalized Guidance: We understand that everyone's financial situation is unique. That's why our coaching adapts to your specific circumstances, ensuring that you receive customized advice and strategies tailored to your needs.

Inclusive and Respectful Environment: No matter your background, financial history, or current situation, you are welcomed here. We're committed to creating an inclusive and respectful space where everyone feels valued and supported.

Results-Oriented Approach: We're not just here to provide advice; we're here to help you achieve tangible results. Our coaching focuses on actionable strategies that lead to lasting change, empowering you to take control of your financial future.

Empowerment at the Core: We believe in empowering you with the knowledge and tools you need to make informed decisions and achieve financial success. Our coaching equips you with the skills and confidence to navigate any financial challenge that comes your way.

So whether you're looking to get out of debt, save for a major purchase, or plan for retirement, "Bartelle’s Money Talk" and Bartelle's Financial Coaching are here to support you every step of the way.

Ready to take the first step toward financial freedom? Schedule a free consultation with Theresa Bartelle today and start your journey to a brighter financial future.

Thank you for considering "Bartelle’s Money Talk" and Bartelle's Financial Coaching. I look forward to hearing from you soon.

Warm regards,

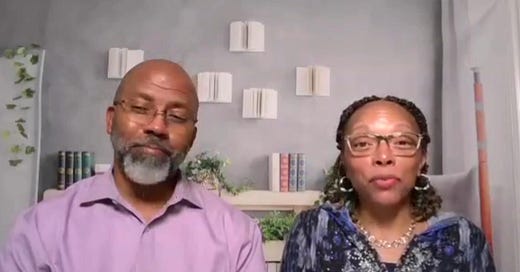

Johnny and Theresa Bartelle

Founders of Bartelle’s Financial Coaching

Share this post